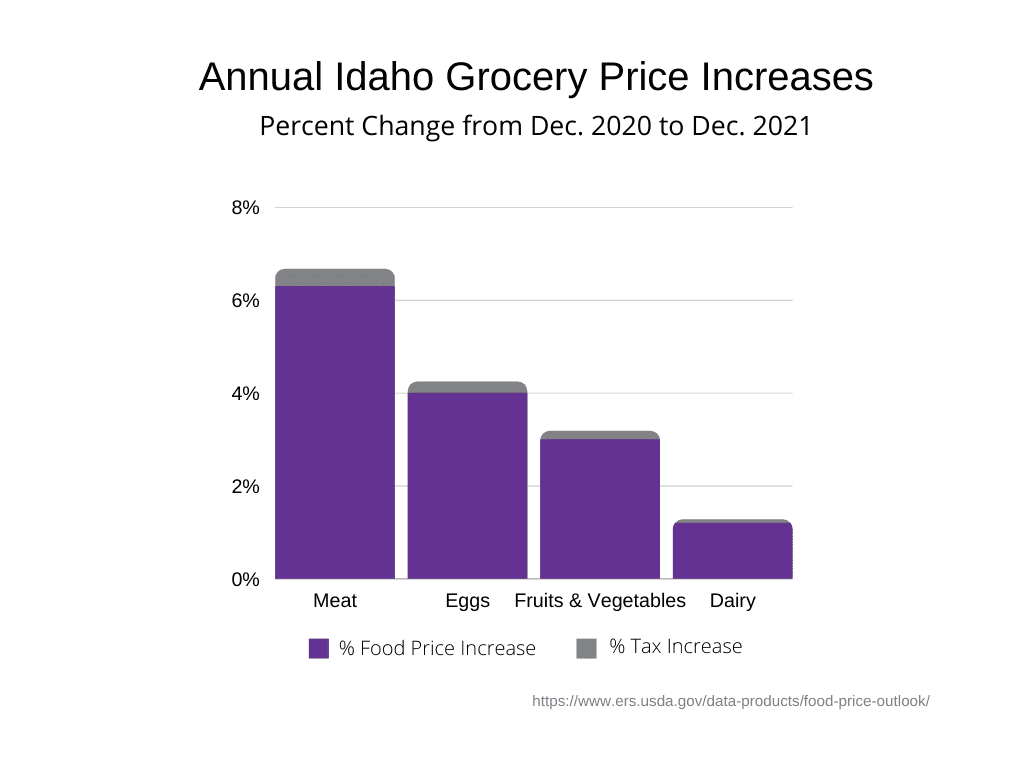

Grocery prices rose by 7.6% last year, making it more difficult for families to afford basic kitchen staples like meat, fruits, vegetables, and dairy. Tacking-on Idaho’s 6% sales tax on groceries only hurts consumers, especially families, by further raising the cost of putting food on the table. After years of debate, this is the perfect time for the Idaho Legislature to offer some relief by finally repealing the grocery tax.

According to the U.S. Department of Agriculture, the average family of four is expected to spend around $836 per month if they stick to a “low-cost” meal plan. That same meal plan was only $790 per month in 2019. Even with wages increasing nationally, the rising prices exceed any increases in compensation by more than 3%. This forces families to be very careful about how they construct their grocery budgets so they can make ends meet.

Given the 6% tax rate, a family can expect to pay more than $50 per month on grocery taxes alone. Though some of these families may qualify for the Gem State’s $100 per person grocery tax credit, families only get this benefit in a lump sum during tax season, leaving them on the hook for the remainder of the year.

Higher food prices generate more tax dollars for the state, too.

Repealing the grocery tax has been an annual debate topic for the Idaho Legislature since 2016. The only time the idea had the support of both chambers of the legislative branch, was when House Bill 67 was vetoed by Gov. Butch Otter in 2017. Recent attempts to reconsider such legislation have been held up by House Speaker Scott Bedke and Rep. Steve Harris, preventing it from being considered for a vote in committee or on the floor. This is in spite of the surprising support this measure has from both conservatives and Democrats.

A developing problem for those who support this tax is the glaring issue of Idaho’s record budget surplus that is now projected to exceed $1.9 billion. At most, grocery tax repeal would only cut into 14% of the surplus and only impose an $80 million hit to the state budget. Given these figures, it is hard to argue why one would need to keep all these funds for no other purpose than becoming the government’s spare change.

Idaho’s families have never needed the relief more than they do now. It is time the Idaho Legislature observes the conservative principles they tout during election season by punctuating this years-long debate with finally repealing the grocery tax.